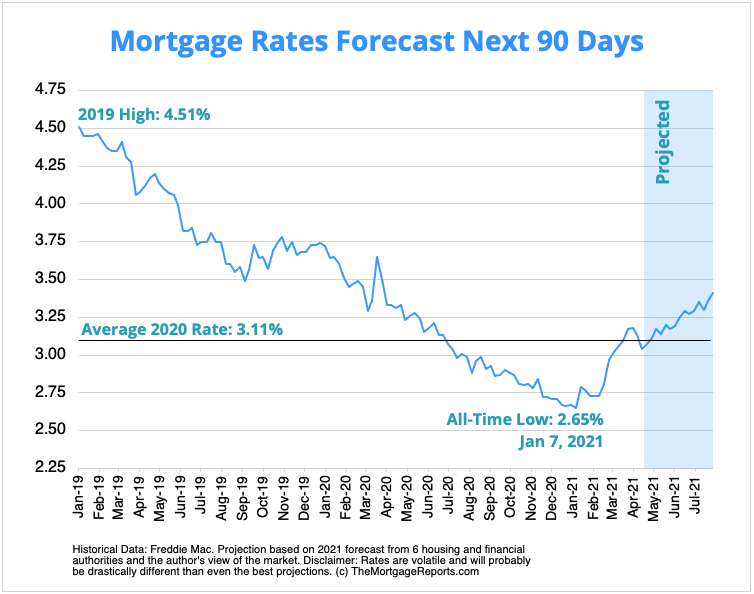

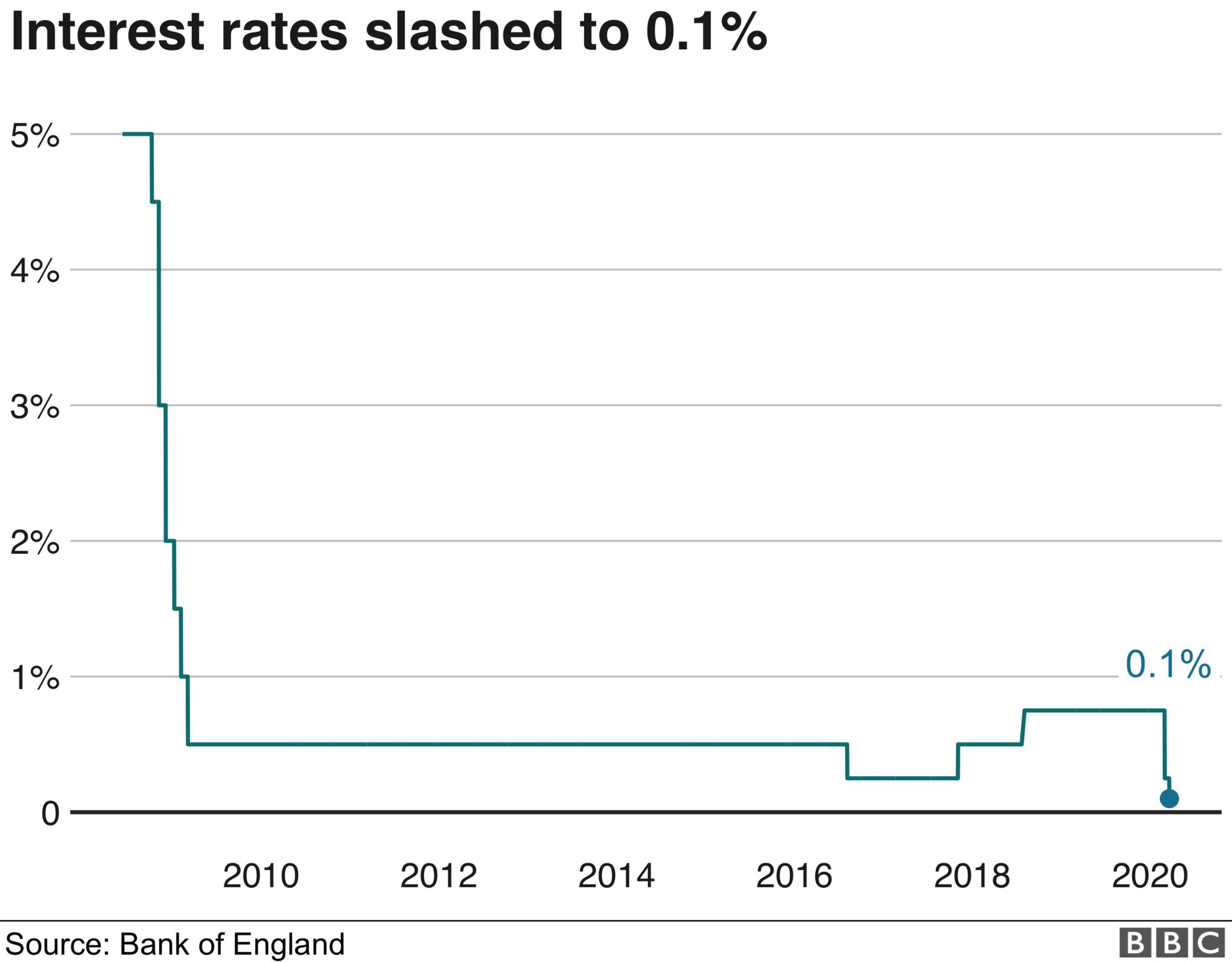

However in many cases savings on moving to a lower fixed rate are. That cut along with a rock-bottom 10-year Treasury yield means mortgage rates are poised to head even lower.

Mortgage Interest Rates Forecast Will Rates Go Down In May

Mortgage Interest Rates Forecast Will Rates Go Down In May

How low could they go.

Could mortgage rates go lower. Meanwhile mortgage rates continue to plummet in a separate survey from Mortgage News Daily. But it might not stop there. Mortgage rates could plunge even lower if the economy spirals again putting us in a double-dip recession says Ralph B.

Mortgage rates have already been hovering near historic lows. At issue is the. Mortgage rates are within a stones throw of record lows.

Why Mortgage Rates Could Go Even Lower 1. However for lenders who set their. Rates could fall to 2 or even 1.

On Thursday it put 30-year mortgage rates at a jaw-dropping new record low. There isnt a shortcut to lower mortgage interest rates without incurring a break cost. Since 2015 my forecasting models have predicted the 10-year Treasury yield would stay in the range of 160 to -3.

First off mortgage rates are only capable of falling so quickly before it begins to cause major problems for the industry. Despite the milestone the day-over-day movement in rates has been pretty mild. The economy might stay sluggish well into 2021 Economic indicators like gross domestic product and the unemployment.

This trend is a return to a smaller more normal gap between mortgage rates and bond yields that we last saw before March. The short answer is that mortgage rates can always go lower. Borrowers on a higher fixed term mortgage rate can look at breaking their fixed mortgage term to get their repayments lower.

Mortgage rates moved lower today bringing the average lender to the best levels since late February. Will mortgage rates go down in May. The 30-year fixed-rate mortgage slid 7 basis points this week to 37 percent and theyve been on a mostly downward track for months.

Already all-time low mortgage rates dropped below 3 for the first time in history this week even while the bonds that usually underlie falling rates remained steady. Technically speaking mortgage rates could go lower. Despite surprise rate drops in April 30-year fixed rates fell to 304 on April 15 mortgage rates seem bound to turn back upwards soon.

But you shouldnt expect them to. Tangential to this the next recession treasury yields and thus mortgage rates. August 18 2020.

The Federal Reserve plans to keep interest rates low The Federal Reserve doesnt control mortgage rates -- but it. Last week rates fell to. Mortgage deals are hitting record lows as lenders compete against each other to have the cheapest rates.

As long as investors can buy mortgage-backed securities while preserving capital theres no limit to how low mortgage rates could go. But breaking a mortgage and resetting at a lower rate can still be a reasonable strategy for getting interest rate certainty for a longer term at low rates For the latest mortgage rates check out TMM Online s rates table. The last week has been typical of recent times with new lower offers appearing almost.

Because mortgage rates are based on the bond market they are really only limited by how low certain bond yields can go. But with millions of homeowners already having refinanced their loans to save hundreds on their monthly mortgage payments it seems almost inconceivable that rates could go still lower in the. This past week the average 30-year fixed-rate mortgage rate hit an all-time low.

McLaughlin chief economist and senior vice president of analytics at Haus. Then the Russians beat the clock on a COVID vaccine and we had a mild uptick in both Treasury yields and mortgage rates.