Rank at or above 250 will be added to the MSCI ACWI Momentum Index on a priority basis. Will be added to the MSCI ACWI Momentum Index on a priority basis.

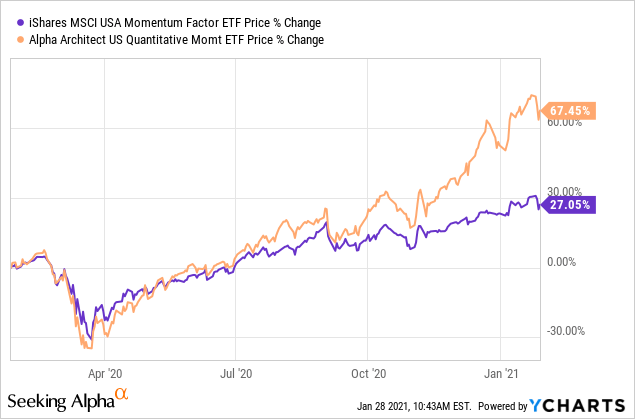

Mtum Ishares Msci Usa Momentum Factor Best Of Class With 5 Years Of History Bats Mtum Seeking Alpha

Mtum Ishares Msci Usa Momentum Factor Best Of Class With 5 Years Of History Bats Mtum Seeking Alpha

The Fund seeks to track the performance of an index that.

Msci usa momentum index. Equity securities identified by the index provider as exhibiting positive momentum characteristics. Large- and mid-capitalization stocks exhibiting relatively higher momentum characteristics before fees and expenses. 1 day agoMSCI USA IMI Utilities Index represents the performance of the utilities sector in the US.

MSCI USA Momentum Index ETF Tracker The index consists of stocks exhibiting higher momentum characteristics than the traditional market capitalization-weighted parent index the MSCI USA Index which includes US. As of 05112021 ETFs Tracking Other Mutual Funds. Current Portfolio buys BTC iShares Floating Rate Bond ETF BTC iShares MSCI USA Momentum Factor ETF Nuveen Municipal Value Fund Inc iShares SP Global Clean Energy Index Fund Johnson Johnson sells JPMorgan Ultra-Short Income ETF PIMCO Active Bond ETF iShares Core SP 500 ETF BTC iShares MSCI USA Min Vol Factor ETF BTC iShares MSCI.

The MSCI factor indexes are rules-based indexes that capture the returns of systematic factors that have historically earned a persistent premium over long periods of timesuch as Value Low Size Low Volatility High Yield Quality and Momentum and Growth. Large- and mid-capitalization stocks exhibiting relatively higher momentum characteristics before fees and expenses. The market capitalization of securities is then weighted based on the Momentum Score.

The MSCI Momentum Tilt Indexes are constructed by including all the constituents in the. The existing constituents that have a Momentum rank between 251 and 750 are then successively added until the number of securities in the MSCI ACWI Momentum Index reaches 500. If the number of securities is below 500 after this step the remaining securities.

On November 23 2020 the ETFs index changed from the MSCI USA Momentum Index to the MSCI USA Momentum SR Variant Index. The iShares MSCI USA Momentum Factor ETF seeks to track the performance of an index that measures the performance of US. The iShares MSCI USA Momentum Factor ETF seeks to track the performance of an index that measures the performance of US.

The existing constituents that have a Momentum rank between 251 and 750 are then successively added until the number of securities in the MSCI ACWI Momentum Index reaches 500. 1 day agoFidelity MSCI Utilities Index ETF carries a Zacks ETF Rank of 3 Hold which is based on expected asset class return expense ratio and momentum among other factors. It is designed to reflect the performance of an equity momentum strategy by emphasizing stocks with high price.

Large- and mid-capitalization stocks. Large- and mid-capitalization stocks exhibiting relatively higher momentum characteristics before fees and expenses. This index is comprised of large and mid-cap US equities which are generally highly liquid and cheaper to trade further reducing the potential effects of transaction costs.

Hold which is based on expected asset class return expense ratio and momentum. Consistent momentum factor exposure cannot be captured. The MSCI USA Momentum Index is based on MSCI USA Index its parent index which captures large and mid cap stocks of the US market.

Approximately USD 236 billion in assets are estimated to be benchmarked to MSCI Factor Indexes1. The iShares MSCI USA Momentum Factor ETF seeks to track the performance of an index that measures the performance of US. Consequently the performance prior to November 23 2020 may have been different that it would have been if this change to the ETF had been in place during the applicable performance measurement periods set out above.

IShares MSCI USA Momentum Factor ETF is an exchange traded fund incorporated in the USA. Investment company Frisch Financial Group Inc. 𝐼 𝐼.

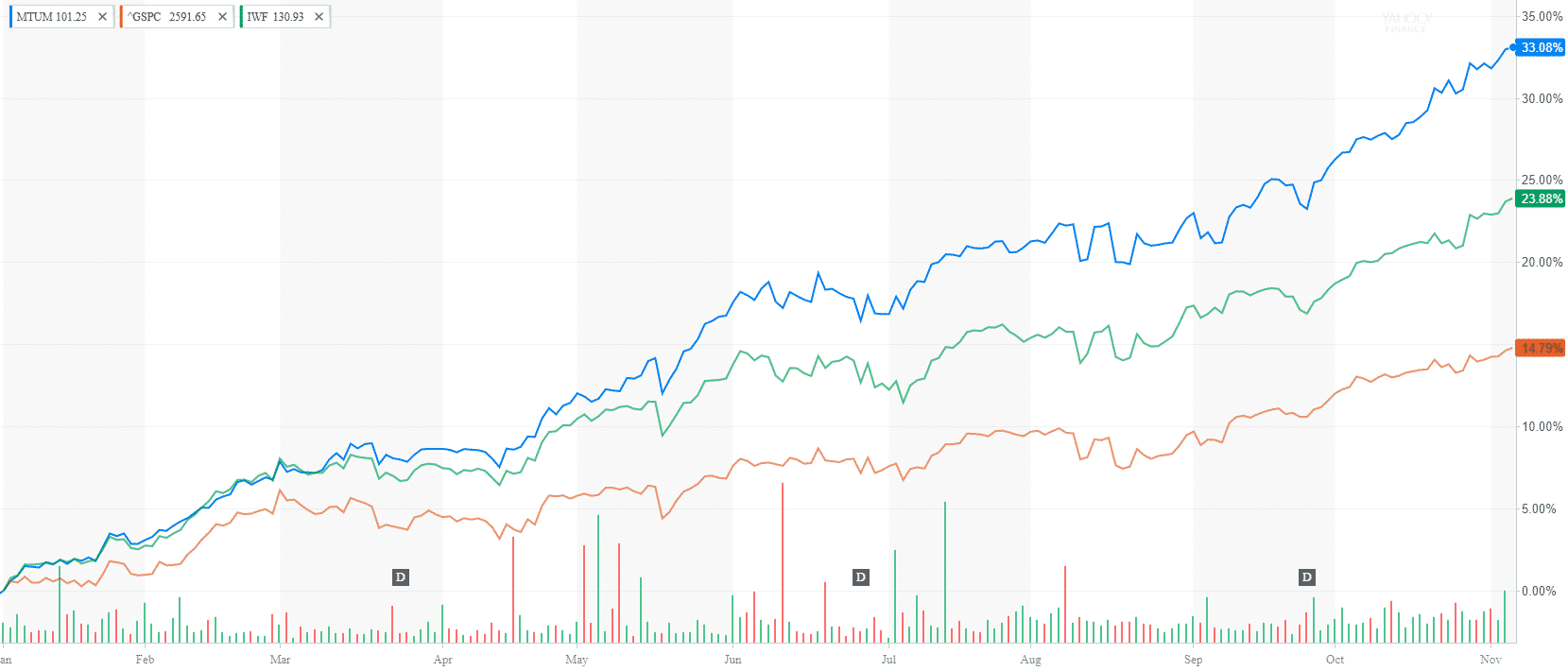

Find the latest iShares MSCI USA Momentum Facto MTUM stock quote history news and other vital information to help you with your stock trading and investing. The ETF has been designed to provide investors with exposure to the performance of an index selected at the discretion of BlackRock Canada that measures the performance of US. It should also be noted that MTUM uses the MSCI USA Index as its starting universe.

The current index for the ETF is the MSCI USA Momentum SR Variant Index. The MSCI Momentum Indexes are constructed by selecting a set number of securities from the Parent Index defined below with the highest Momentum Scores defined in section 2. Journal of Finance 1993.

MSCI USA Momentum SR Variant Index 𝐼 are calculated as below.