Thank God for the 1. In 2018 the top 1 of taxpayers defined as those with adjusted gross income above 540009 earned 209 of all adjusted gross income AGI and paid 401.

Summary Of The Latest Federal Income Tax Data 2018 Update

Summary Of The Latest Federal Income Tax Data 2018 Update

The latest government data show that in 2018 the top 1 of income earnersthose who earned more than 540000earned 21 of all US.

Percent of taxes paid by top 1. Theres too little money spread over too many people. Does the Top 20 Income Earners Pay 95 of the Total Tax. Meanwhile the share of income tax paid by the top 1 of taxpayers a smaller slice of the population because so many people pay no income tax has risen from 24 of the total in 2007-08 on the.

According to an analysis by the nonpartisan Tax Policy Center the top 1 those making over 783300 24 million on average will pay about an average federal tax rate of 302 in 2019. The top 1 are projected to pay about 28 of income tax in 201718 so Theresa Mays claim would be roughly correct if talking just about this. This suggests that policy makers wishing to mitigate regressive features of the tax system should look elsewhere.

The top 5 paid around 58. The top 20 percent of Americans pay almost 90 percent of all federal income taxes. Thats more than the bottom.

So if this is true what else is true about who pays taxes in the good ole US of A. This site earns revenue from ads some within content. In 2018 the top 1 of US.

The same figures though show top earners paid slightly more in 201516 at about 29 of income taxes. Of course they arent paying a lot in income taxes because they dont make. The bottom 50 percent of Americans pay just 3 percent of federal income taxes.

Income while paying 40 of all federal income taxes. If a tax bill that provided that 39 of the benefits went to the top 1. Forty percent couldnt cover an unexpected 400 expense with cash.

The top 1 percent of all households got 18 percent of all personal income and paid nearly 28 percent of all federal taxes in 2005 according to the Congressional Budget Office. Prior to enactment of the bill the top 1 paid about 39 of Federal taxes. So its not correct to say this is a record percentage in any case.

Earners paid roughly 37 of all federal income taxes. State and local sales and property taxes may be a more promising area for reform. The top 1 percent of American earners pay almost 40 percent of all federal income taxes.

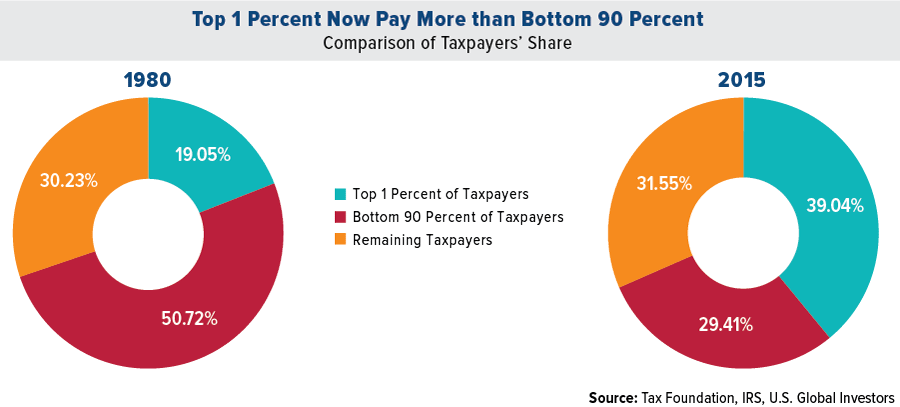

That is one of the most eye-catching figures in a study released by the Tax Foundation earlier this month. Percentage wise that means the top 1 pay over 40 of all taxes annually in America. The top 1 of taxpayers those who earn 515371 or more paid 3847 of the total tax revenue collected in 2017 according to the latest figures from the IRS.

That much-maligned minority the richest percent of Americans pay 395 of all Federal Income Tax. According to a projection from the non-partisan Tax Policy Center the top 1 percent of Americans will pay 457 percent of the individual.