Along with the standard brokerage services Vanguard also offers variable and fixed annuities educational account services financial planning asset management and trust services. Vanguard Brokerage Review Vanguard began operations back in 1975 although its oldest fund the Vanguard Wellington Fund was incepted in 1929.

Vanguard Vs J P Morgan Chase 2021

Vanguard Vs J P Morgan Chase 2021

Check out this in-depth Vanguard review and learn if this brokerage account is right for you.

Is vanguard a brokerage. The Vanguard brokerage platform also offers personal advisor services that include a customized financial plan goal-setting and investment advice. Lets have a look. For the right kind of investor the lack of a.

Vanguard is the best online brokerage for the buy and hold investor and particularly those with large portfolios of 500k but they are also good for smaller portfolios of at least 3000. Even if you dislike the way Vanguard has set up its investment process you would still be able to invest in Vanguard products through other brokers and platforms such as M1 Finance. The personal advisor service does come with a fee of 003 of your total assets.

Vanguard Pros Commission-free trading. In the same spirit of shedding further insight on the different investment options available to consumers today I wanted to share with you my experiences with Vanguards Investment. ETFs are subject to market volatility.

Several mutual funds managed by Vanguard are ranked at the top of the list of US mutual funds by assets under management. Vanguard is the king of low-cost investing making it ideal for buy-and-hold investors and retirement savers. Vanguard ist heute einer der renommiertesten Online-Börsenmakler.

While in some ways Vanguard is still an old-school brokerage firm the company has launched a new 0 commission schedule for 2021 that attempts to rival cutting-edge firms. See the Vanguard Brokerage Services commission and fee schedules for limits. Vanguard is not a broker for active traders so the broker does not offer anything more than a basic order interface.

Gegründet von John C. The company is regulated by the Securities and Exchange Commission SEC and the Financial Industry Regulatory Authority FINRA. You must buy and sell Vanguard ETF Shares through Vanguard Brokerage Services we offer them commission-free or through another broker which may charge commissions.

Flexibility You can hold Vanguard mutual funds and ETFs exchange-traded funds stocks bonds and CDs. The first thing that is important to understand is that there is a difference between Vanguards products and Vanguard as a broker. But does it have enough to outdo them.

You must buy and sell Vanguard ETF Shares through Vanguard Brokerage Services we offer them commission-free or through another broker which may charge commissions. It now offers zero. Vanguard is a member of FINRA In order to protect your investments from fraud Vanguard is registered by the Federal Industry Regulatory Authority.

But active traders will find the broker falls short despite its. The bottom line. Vanguard is also a great platform for those who want a no-frills and cost effective option for their portfolio.

The company currently manages about 51 trillion in global assets from over 20 million investors in about 170 countries. When you sell a stock or bond you can reinvest your profits in Vanguard funds right away. Vanguards range of offerings includes stocks and ETFs OTCBB also known as penny stocks mutual funds bonds including corporate municipal treasury and CDs simple single leg-options multi-leg options via live broker the two robo-advisors Vanguard Personal Advisor Services and Vanguard Digital Advisor and international trading.

Bogle dem Erfinder des ersten Indexfonds ist Vanguards Investitionsphilosophie kostengünstig langfristig und problemlosVanguard bietet die ganze Palette an Anlagedienstleistungen an darunter IRAs 401000 Rollover 529 College-Sparpläne Investmentfondskonten. Vanguard is considered safe because it has a long track record and it is overseen by top-tier regulators. If you suspect fraud due to how Vanguard handles your investments you can go to this watchdog agency to investigate the claim.

Vanguard has finally succumbed to the brokerage price war. Vanguard ETF Shares arent redeemable directly with the issuing fund other than in very large aggregations worth millions of dollars. Vanguard is a top brokerage platform that offers low-cost mutual funds with no account minimums.

In addition to mutual funds and ETFs Vanguard offers brokerage services variable and fixed annuities educational account services financial planning asset management and trust services. The Vanguard Brokerage Account offers an easy way to organize and manage all your investments and so much more. The sooner you move your Vanguard funds to a brokerage account the sooner you can take advantage of these great benefits.

Vanguard ETF Shares arent redeemable directly with the issuing fund other than in very large aggregations worth. Check out FINRAs brokercheck service for Vanguard. Vanguard is a US stockbroker founded in 1975.

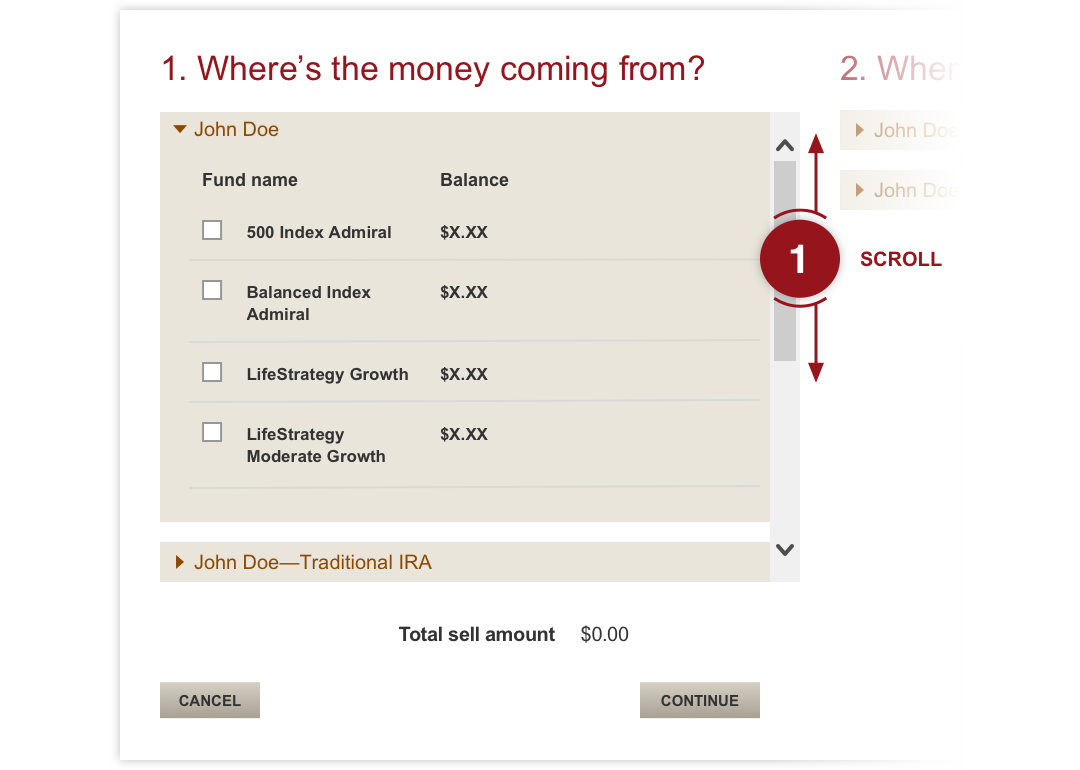

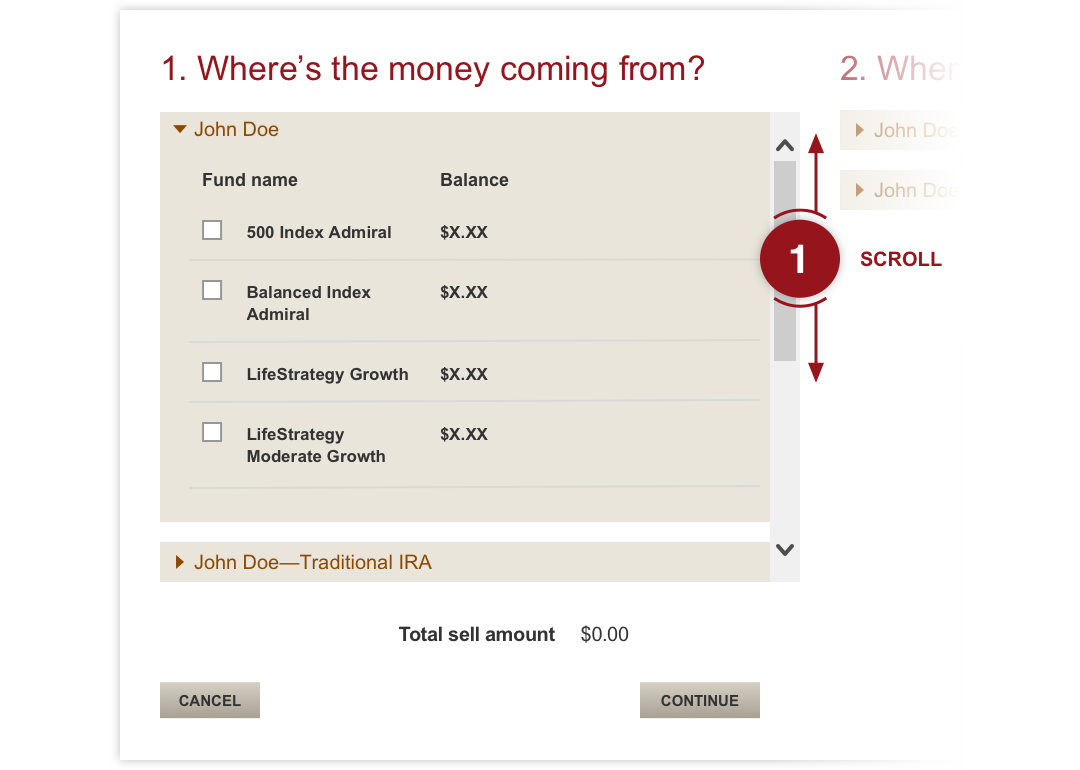

How Do I Buy A Vanguard Mutual Fund Online Vanguard

How Do I Buy A Vanguard Mutual Fund Online Vanguard

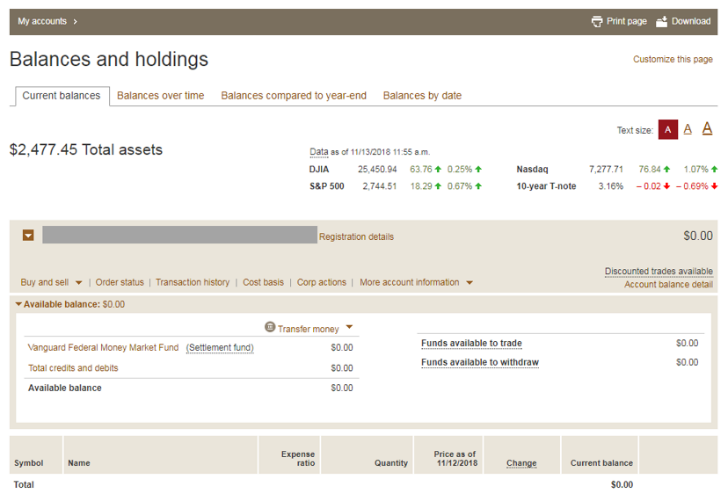

Vanguard Merged Brokerage Account Review Pros And Cons My Money Blog

Vanguard Merged Brokerage Account Review Pros And Cons My Money Blog

Vanguard 101 Automatic Investments Fly To Fi

Vanguard 101 Automatic Investments Fly To Fi

Vanguard Fractional Shares Buy Partial Stock Share In 2021

Vanguard Fractional Shares Buy Partial Stock Share In 2021

How To Close A Vanguard Account Closing Fee 2021

How To Close A Vanguard Account Closing Fee 2021

Vanguard Brokerage Review Smartasset

Vanguard Brokerage Review Smartasset

Vanguard Review 2021 Pros And Cons Uncovered

Vanguard Review 2021 Pros And Cons Uncovered

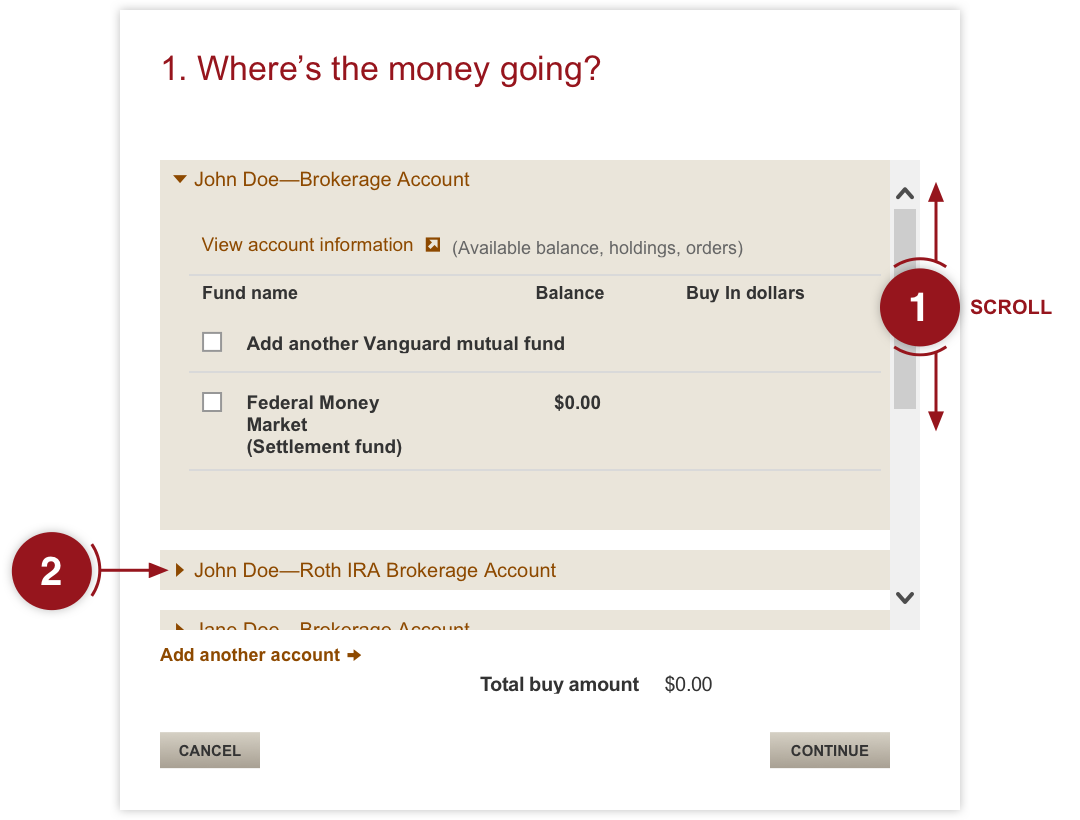

How Do I Exchange A Vanguard Mutual Fund For Another Vanguard Mutual Fund Online Vanguard

How Do I Exchange A Vanguard Mutual Fund For Another Vanguard Mutual Fund Online Vanguard

Vanguard Review 2021 Pros And Cons Uncovered

Vanguard Review 2021 Pros And Cons Uncovered

Vanguard Review 2021 Pros Cons Fees Features Benzinga

Vanguard Review 2021 Pros Cons Fees Features Benzinga

:max_bytes(150000):strip_icc()/Vanguard_portfolio_watch-eeb3c935ef08429dbd129bd37aba586b.jpg)

:max_bytes(150000):strip_icc()/ScreenShot2020-03-16at5.09.54PM-e542d6ef5216476dbe0428c9d467a6c9.png)

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.